For millennials, generally defined as those 24 to 39, becoming a homeowner can feel out of reach. Just 33.7% of people under 35 owned homes in 2018, significantly below the national average of nearly 64%, according to data from the U.S. Census Bureau.

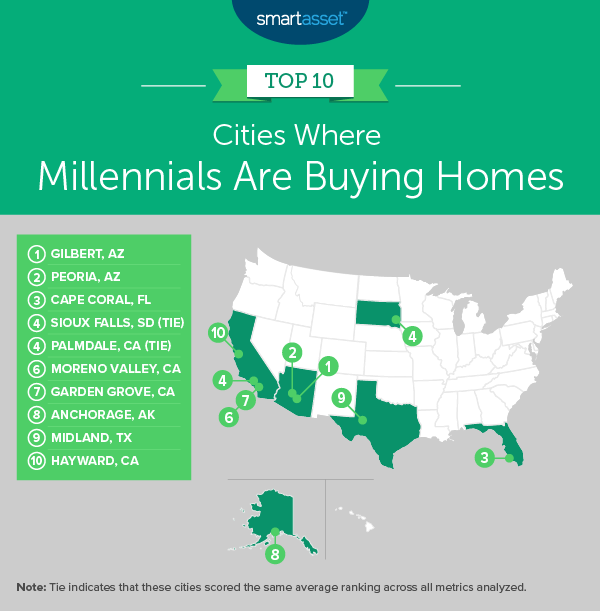

But there is some good news: There are several U.S. cities where it’s become increasingly routine for young people to buy homes, a 2020 study from personal finance website SmartAsset found.

SmartAsset ranked 200 large U.S. cities based on two metrics: the percentage of residents under 35 who own homes and the 10-year change in the under 35 homeownership rate, which is the percentage change in homeownership among those 18 to 34 from 2009 to 2018. SmartAsset found each area’s average ranking and used it as the city’s final score, out of a possible 100.

For the study, SmartAsset used data from U.S. Census Bureau’s 2009 and 2018 1-year American Community Surveys.

The cities with the most millennial homeowners are commonly located in western areas of the country. In fact, seven of the top 10 cities can be found in Arizona, California or Alaska. Florida is making the list for the first time with the city of Cape Coral.

Here’s a closer look at the top 10 cities where a significant portion of young people own homes.

10. Hayward, California

- 2018 millennial homeownership rate: 34.26%

- 10-year change in under 35 homeownership rate 2009 to 2018: 4.10%

- Overall score: 88.56

9. Midland, Texas

- 2018 millennial homeownership rate: 37.94%

- 10-year change in under 35 homeownership rate 2009 to 2018: 2.64%

- Overall score: 89.65e violin

8. Anchorage, Alaska

- 2018 millennial homeownership rate: 37.73%

- 10-year change in under 35 homeownership rate 2009 to 2018: 3.11%

- Overall score: 90.46

7. Garden Grove, California

- 2018 millennial homeownership rate: 35.05%

- 10-year change in under 35 homeownership rate 2009 to 2018: 8.81%

- Overall score: 92.10

6. Moreno Valley, California

- 2018 millennial homeownership rate: 48.22%

- 10-year change in under 35 homeownership rate 2009 to 2018: 4.42%

- Overall score: 95.91

4. TIE: Palmdale, California

- 2018 millennial homeownership rate: 45.71%

- 10-year change in under 35 homeownership rate 2009 to 2018: 10%

- Overall score: 97.82

4. TIE: Sioux Falls, South Dakota

- 2018 millennial homeownership rate: 48.83%

- 10-year change in under 35 homeownership rate 2009 to 2018: 7.98%

- Overall score: 97.82

3. Cape Coral, Florida

- 2018 millennial homeownership rate: 55.81%

- 10-year change in under 35 homeownership rate 2009 to 2018: 8.98%

- Overall score: 99.46

2. Peoria, Arizona

- 2018 millennial homeownership rate: 60.48%

- 10-year change in under 35 homeownership rate 2009 to 2018: 8.46%

- Overall score: 99.73

1. Gilbert, Arizona

- 2018 millennial homeownership rate: 56.56%

- 10-year change in under 35 homeownership rate 2009 to 2018: 9.17%

- Overall score: 100

Why aren’t millennials buying?

Despite the fact that millennials are buying homes in certain parts of the U.S., under 35 homeownership rates in general are on the decline, SmartAsset reports.

The homeownership rate for Americans 18 to 34 decreased from 36.5% in 2009 to 33.7% in 2018. Of the 200 cities SmartAsset ranked, 152 saw declines over the last 10 years.

Why isn’t this generation buying? Rising housing prices could be one factor. Plus, experts say expensive student loans often keep millennials from taking on the additional debt that comes with buying a home.

“They have so much student loan debt that it would be difficult to take on another large payment each month,” says Ryan Marshall, a certified financial planner at Ela Financial Group. “Some of their student loan payments are as much if not more than a typical mortgage payment in certain parts of the country.”

“Many millennials have minimal free cash flow due to student loan debt and living in high cost areas like San Francisco, Los Angeles and New York City,” Paddock says.

Additionally for millennials, who have been referred to as “generation rent,” the fear of committing to a location is also sometimes a factor, Paddock explains.

“I’ve also seen many millennials intentionally choosing to not buy a home because they don’t want to be tied down to one location. They enjoy the flexibility that non-homeownership provides them,” Paddock says. “There is flexibility in where they live — along with financial flexibility — since they aren’t tying up a large portion of their finances in a home.”